Welcome to my website. I launced a website in the early 2000’s to share my academic work and to show off my digital photography. Following the demise of gandini.unm.edu, which I had hosted for over 10 years, I launched this website in 2013. Unfortunately the website has languished in recent years and I haven’t been posting or updating photos as I should.

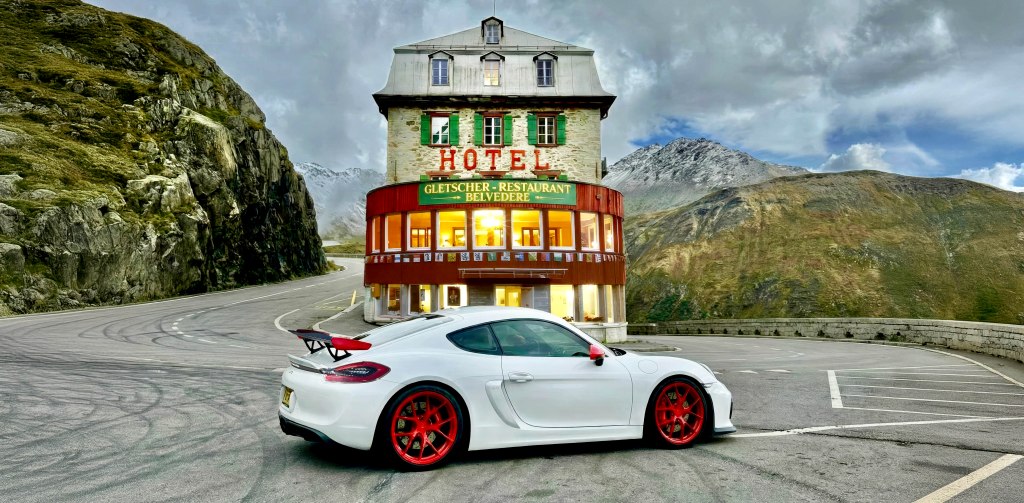

I post occasionally to a blog called UnPhiltered. There are my personal pages allowing me to share a little of myself. You can read about my obsession with my car, bicycles, photography, woodwork and a few other things. My photography site has been around the web the longest and doesn’t get the attention from me it deserves I’m afraid.

I retired from academic life in 2023. After 34 years it seemed like a good time to leave, especially since the woke culture had completely taken over the University and it no longer felt like the institution I had joined all those years ago. It was no longer my University, so I was no longer someone who should be working there.

As an archive of sorts, you’ll find an academic section with details on my research and the classes I taught. I had a long administrative career, as Chair of the Economics Department, Director of the BA/MD program with the Medical School, Associate Dean for Research, Senior Associate Dean and Associate Dean for Faculty in the College of Arts and Sciences. There’s also a section about the consulting and expert witness services I used to offer to the legal profession. I retired from forensic economics in 2023 also.

I hope you find something of interest here. If you do, please find me on Facebook (where am drPhilGandini or my group Spin In Style or on Instagram as @spininstyle.) Thanks for visiting, and cheers!

Phil Ganderton

(Throughout the website you can click on most photos to see a larger image)